Warner Bros. Discovery has issued a warning to shareholders that the offer tabled by Paramount Skydance, amended on December 22, is not in the best interests of them or the company and doesn't meet the criteria of a superior proposal to the merger agreement with Netflix announced on December 5.

WBD announced its merger with Netflix much to the chagrin of Paramount, believing they had tabled a much more lucrative deal and pushing forward with that argument. WBD has continued to maintain that accepting Paramount's offer would not serve to benefit the future of WBD or its shareholders, and on Wednesday issued another warning to that effect.

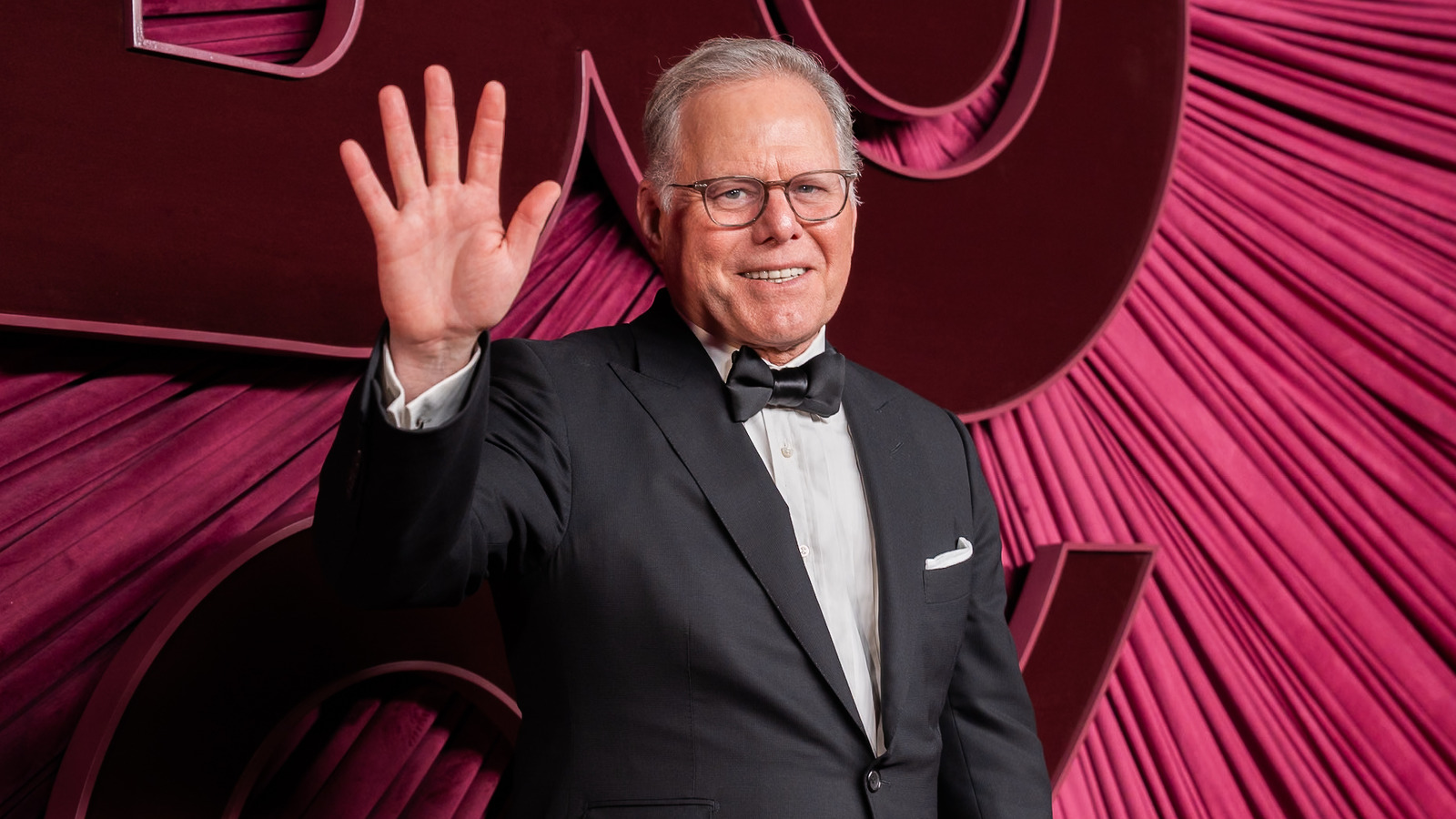

"The Board unanimously determined that Paramount's latest offer remains inferior to our merger agreement with Netflix across multiple key areas," said Samuel A. Di Piazza, Chairman of the Board. "Paramount's offer continues to provide insufficient value, including terms such as an extraordinary amount of debt financing that create risks to close and lack of protections for our shareholders if a transaction is not completed. Our binding agreement with Netflix will offer superior value at greater levels of certainty, without the significant risks and costs Paramount's offer would impose on our shareholders."

Paramount made a $108 billion offer to WBD shareholders, claiming they'd be a better partner to work with than Netflix. As opposed to Netflix, Paramount is looking to acquire the entirety of WBD instead of a merger.

A letter to shareholders noted that, under the Netflix agreement, they would receive significant value in $23.25 in cash and shares of Netflix common stock. Additionally, shareholders would receive value through their ownership in Discovery Global.

Whereas, in accepting an offer from Paramount, it's argued that WBD would have to pay a $2.8 billion termination fee to Netflix for the existing merger agreement, a $1.5 billion fee for failing to complete a debt exchange, and an incremental interest expense of approximately $350 million.

There is also a lack of belief that the deal with Paramount could close, with it holding a pre-existing $14 billion market cap and attempting to execute an acquisition requiring $94.65 billion of financing, almost seven times its market cap. Simply put, WBD argues that Netflix can afford the merger agreement while Paramount cannot, and such a transaction as the latter is believed to be too large a risk compared to the former.

It's also said that Paramount has continued to submit offers including deficiencies outlined by WBD, all while asserting that said offers do not represent "its best and final" proposal.

"They are well aware of the reasons behind the Board's determination that the Netflix merger agreement is superior to its offer. If on December 4 [Paramount] did not recognize the weaknesses of its proposal when the Board concluded the process, it has now had several weeks to study the Netflix merger agreement and adjust its offer accordingly. Instead [Paramount] has, for whatever reason, chosen not to do so."